north carolina estate tax 2020

Counties in North Carolina collect an average of 078 of a propertys assesed fair market value as property tax per year. The median property tax in North Carolina is 120900 per year for a home worth the median value of 15550000.

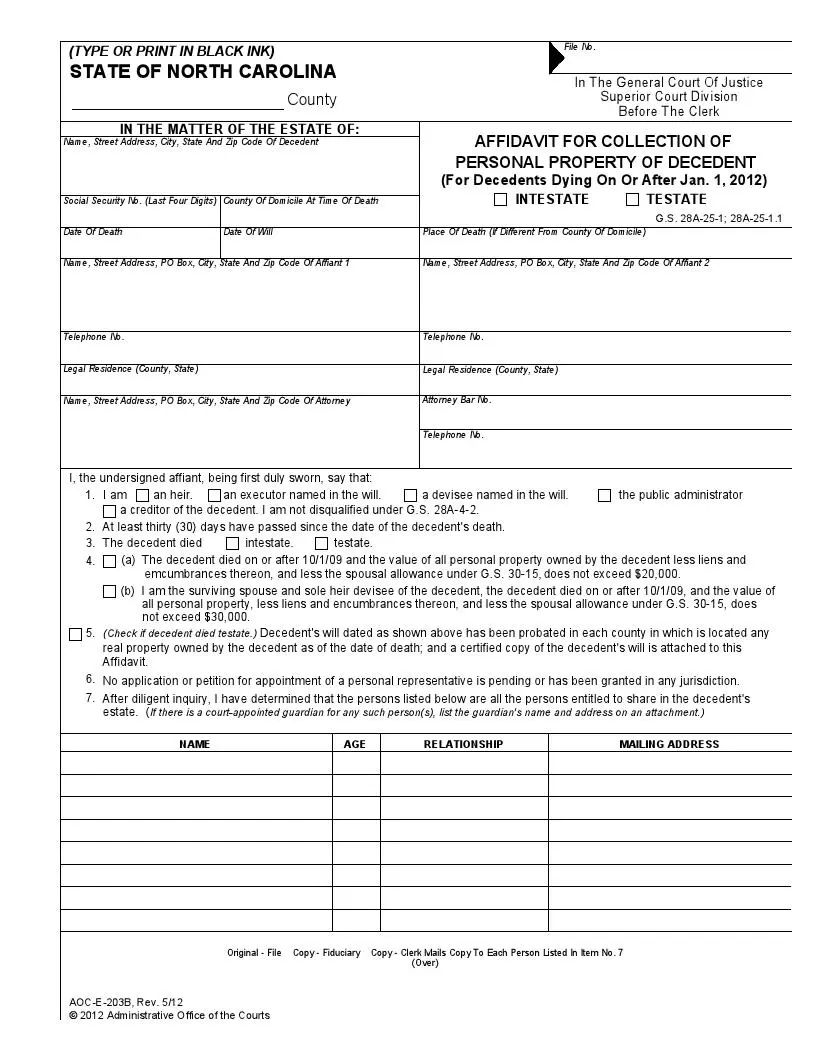

Free North Carolina Small Estate Affidavit Form Pdf Formspal

For tax year 2021 Michigans personal exemption has increased to 4900 up from 4750 in 2020.

. Tax amount varies by county The median property tax in North Carolina is 120900 per year for a home worth the median value of 15550000. Complete this version using your computer to enter the required information. Owner or Beneficiarys Share of NC.

The North Carolina D-400 instructions and the most commonly filed individual income tax forms are listed below on this page. 078 of home value. Then print and file the form.

The federal estate tax exemption is 1206 million in 2022 so only estates larger than that amount will owe federal estate taxes. 7142020 20756 PM. Just click on a city name to view the estate sales and auctions that are being held by companies in NCIf you are holding an estate sale or auction and would like to be a part of EstateSalesNET join us.

This is an official form from the North Carolina Administration of the Courts AOC which complies with all applicable laws and statutes. 2020 D-407 Estates and Trusts Income Tax Return Files 2020-D407-webfillpdf Webfill version. Those with an adjusted gross income above those amounts pay 20 percent in capital gains taxes.

Property Left to the Surviving Spouse. Any federal or state gift and estate tax due however is paid by the estate during the probate of the estate. Beneficiarys Share of North Carolina Income Adjustments and Credits.

The state of North Carolina requires you to pay taxes if you are a resident or nonresident that receives income from a California source. The state income tax rate is 525 and the sales tax rate. Beginning in 2019 the cap on the Connecticut state estate and gift tax is reduced from 20 million to 15 million which represents the tax due on a Connecticut estate of approximately 129 million.

North Carolina Estate Tax Exemption. Estate Taxes for Married Couples Portability. North Carolina repealed the state-level estate tax in July 2013 effective retroactively for deaths occuring on January 1 2013 or later.

Application for Extension for Filing Estate or Trust Tax Return. Select the North Carolina city from the list of popular cities below to see its current sales tax rate. Link is external 2021.

North Carolina has recent rate changes Fri Jan 01 2021. Fifteen counties had a tax rate change in 2020-21 with four counties increasing and eleven counties decreasing their rate. PDF 33221 KB - January 04.

North Carolina Salary Tax Calculator for the Tax Year 202122 You are able to use our North Carolina State Tax Calculator to calculate your total tax costs in the tax year 202122. North Carolina repealed the state-level estate tax in July 2013 effective retroactively for deaths occuring on January 1 2013 or later. The state sales tax rate in North Carolina is 4750.

USLF amends and updates the forms as is required by North Carolina statutes and law. Thus for deaths occurring on January 1 2013 or later only the Federal estate tax rules apply for North Carolina decedents. Connecticuts estate tax will have a flat rate of 12 percent by 2023.

Twenty-six counties had a revaluation in 2019 and 12 counties have one in 2020. 2020-2021 TAX RATE CHARTxlsx Author. North Carolina Association of County Commissioners 323 West Jones Street Suite 500 Raleigh NC 27603 Mailing.

7A-307a7 to create a. NC K-1 Supplemental Schedule. The state income tax rate is displayed on the North Carolina D-400 form and can also be found inside the North Carolina D-400 instructions booklet.

Federal exemption for deaths on or after January 1 2023. Those with an adjusted gross income of 38601 through 425800 for single filers 51701 through 452401 for heads of households and 77201 through 479000 for married couples filing jointly pay 15 percent in capital gains taxes. PO Box 27288 Raleigh NC.

Estate Tax Certification For Decedents Dying On Or After 1199. 102 rows 2020-21 Property Tax Rate 2019-20 Property Tax Rate. The North Carolina income tax rate for tax year 2021 is 525.

Counties in North Carolina collect an average of 078 of a propertys assesed fair market value as property tax per year. We will notify hundreds or even thousands of people who have signed. After Aunt Ruths estate deducts the exemption she would only owe gift and estate taxes on the remaining 155 million taxed at the rate of 40 percent.

With local taxes the total sales tax rate is between 6750 and 7500. Up to 25 cash back However now that North Carolina has eliminated its estate tax most wealthy North Carolina residents will owe estate taxes only to the federal government. North Carolina Estate Sales Tag Sale Listed below are the cities of North Carolina that we serve.

The median property tax in North Carolina is 120900 per year for a home worth the median value of 15550000. Therefore a beneficiary or heir need not worry about gift and estate taxes.

North Carolina State Taxes 2022 Tax Season Forbes Advisor

A Guide To North Carolina Inheritance Laws

Understanding North Carolina Inheritance Law

Guide To Nc Inheritance And Estate Tax Laws Hopler Wilms Hanna

Lexisnexis Practice Guide North Carolina Estate Planning Lexisnexis Store

A Guide To North Carolina Inheritance Laws

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

North Carolina Estate Tax Everything You Need To Know Smartasset

Asset Protection In North Carolina What Can You Do To Protect Your Assets From Your Creditors Creditors Estate Planning Asset

A Guide To North Carolina Inheritance Laws

A P Pearsall Estate Circa Old Houses Old Houses For Sale And Historic Real Estate Listings Old Houses Abandoned Mansion For Sale Historic Homes

How Do State Estate And Inheritance Taxes Work Tax Policy Center

![]()

Estate Tax What Is The Current Estate Tax Exemption Carolina Family Estate Planning

An 1800s Era South Carolina Estate With A Modern Party Space Asks 21 Million Modern Party City Of Charleston Estates

North Carolina Tax Reform North Carolina Tax Competitiveness

North Carolina Tax Reform North Carolina Tax Competitiveness

North Carolina Estate Tax Everything You Need To Know Smartasset

North Carolina Estate Tax Everything You Need To Know Smartasset

2020 Was The Right Time To Increase My Real Estate Portfolio By 1 Million Wealth Building Estate Tax Being A Landlord